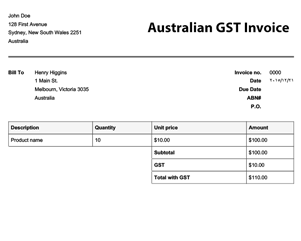

Invoice Template Australia No GST: Hello folks! Today, we’re diving into a topic that many people in Australia wonder about: how to use an Invoice Template Australia No GST. If you need clarification on what GST means, it’s short for Goods and Services Tax. Not all businesses need to include GST in their invoices, and that’s where these special templates come in handy.

What is an Invoice Template Australia No GST?

Invoice Template Australia No GST It’s a ready-made form that helps you ask for money for stuff you’ve sold or services you’ve given, but without adding GST. It is really helpful if you don’t have to charge GST for your work.

Why Use a No-GST Invoice Template?

You might be asking, “Why should I use a special No-GST template?” Well, here are some good reasons:

- It’s the law for certain types of sales.

- It makes things clear for your customers.

- It can save you from making mistakes.

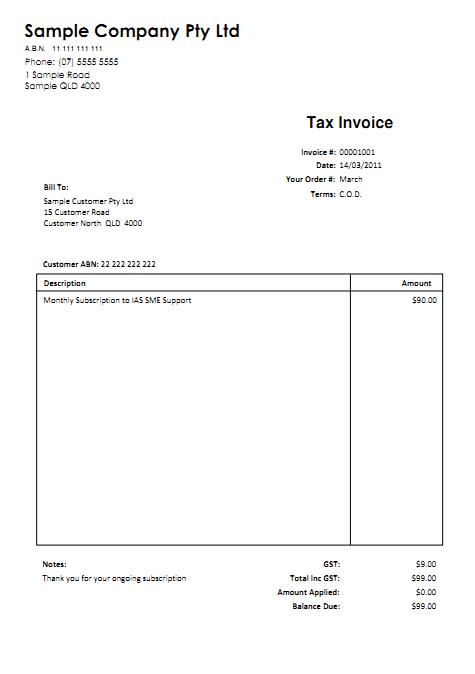

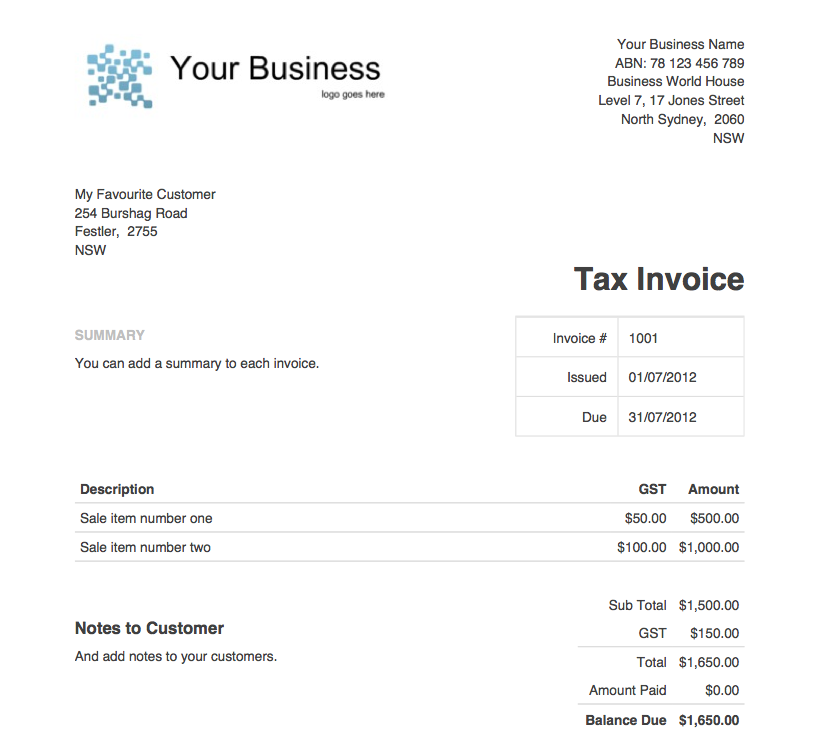

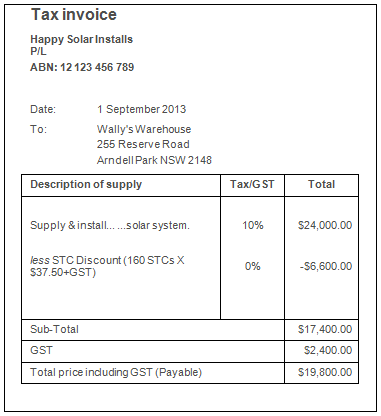

Essential Components of a Invoice Template Australia No Gst

Let’s talk about what you should put on this kind of invoice:

- Your business name and how to contact you.

- Who you’re billing and their contact info.

- What you’re selling or the service you’re giving.

- The cost of what you’re selling or doing.

- The words “No GST has been charged.”

Common Mistakes to Dodge and How to Avoid Them

When you’re using an Invoice Template Australia No GST, it’s really easy to make some errors if you’re not careful. But don’t worry; we’re here to help you avoid those traps.

Mistake 1: Forgetting to Write “No GST Has Been Charged”

- Why It’s a Problem: If you put this, your customer might understand. They might think they have to pay GST when they really don’t.

- How to Avoid It: Always double-check your invoice before sending it out. Make sure you’ve clearly written “No GST has been charged” so it’s easy to see.

Mistake 2: Leaving Out Important Details

- Why It’s a Problem: More information is needed to lead to understanding. Your customer needs to know what they’re paying for.

- How to Avoid It: Go over the invoice carefully. Make sure you’ve filled in all the important spots, like your business name, what you’re selling, and the total price.

Mistake 3: Not Keeping a Copy for Yourself

- Why It’s a Problem: If you keep a copy, you will have proof of what you billed. It is really important for your records, and in case there’s ever a question about it later.

- How to Avoid It: Always save a copy of the invoice on your computer or print one out for your files before you send it to your customer.

Step-by-Step Guide to Creating a No-GST Invoice in Various Formats

Choose Your Format First

You’ve got some choices when it comes to making a No-GST invoice. You can use Word, PDF, or Excel. Each one has its perks, so let’s dive in and see which one fits you best.

Option 1: Using Word for Your No-GST Invoice

Pros:

- Easy to Edit:Word makes it super simple to type in your info.

- Easy to Print:Once you’re done, just hit the print button.

- How to Do It:

- Open a new Word document.

- Use a No-GST invoice template or create your own.

- Fill in all the blanks with your details.

- Don’t forget to write, “No GST has been charged.”

- Save and print your invoice.

Option 2: Going the PDF Route

Pros:

- Consistent Look:No matter where you open it, it looks the same.

Cons:

- Harder to Edit:Once it’s a PDF, changing it can be tricky.

- How to Do It:

- You can start with a Word or Excel file.

- Once you’re done, save it as a PDF.

- Double-check to make sure “No GST has been charged” is clearly written.

Option 3: The Excel Way

- Pros:

- Automatic Calculations:If math isn’t your strong suit, Excel can be a lifesaver.

- How to Do It:

- Open a new Excel sheet.

- Use a No-GST invoice template or make your own.

- Fill in your details.

- Use Excel formulas to do any math for you.

- Make sure to include “No GST has been charged.”

- Save your invoice, and you can also convert it to PDF if you want.

Legal Stuff You Need to Know About No-GST Invoices in Australia

When it comes to money and business, you’ve got to follow the law. In Australia, this is especially true if you’re not charging GST on your invoices. You need to make sure your customer knows they’re not being charged any extra tax.

The Golden Rule: Always State, “No GST Has Been Charged.”

- Why You Must Do This:

- It’s a legal requirement in Australia.

- It keeps things super clear for your customer.

- If you don’t do this, you could get into trouble.

- Where to Put It:

- Make sure these words are easy to see. Put them near the total price or at the bottom of the invoice.

What Happens If You Forget?

If you forget to include “No GST has been charged,” you could confuse your customer. Even worse, you might end up breaking the law. That could mean fines or other problems that no one wants to deal with.

Double-Check Before You Send

Before you hit that send button or print out the invoice, double-check to make sure you’ve included “No GST has been charged.” It’s a small thing that can save you a lot of trouble later on.

FAQs

What Exactly is an Invoice Template Australia No GST?

It’s a special form you can use to bill someone if you’re not charging them GST. It has all the spots you need to fill in but leaves out the GST part.

Do I Really Need to Use One?

If you’re not charging GST, it’s a really good idea. It makes sure you remember to include all important details.

Where Can I Find These Templates?

Just hop online and search for “Invoice Template Australia No GST.” You’ll find plenty of free options!

Can I Make My Own?

Sure, you can! But make sure it has all the important info like your business name, what you’re selling, and the words “No GST has been charged.”

What Should I Do If I Make a Mistake on the Invoice?

No worries, it happens! Just make a new one, and make sure to mark the old one as “canceled.”

Can I Use a Regular Invoice Template and Remove the GST?

You could, but be super careful. You need to make sure all the other important info is still there.

What Format is Best for a No-GST Invoice?

You can use Word, PDF, or Excel. Pick the one you’re most comfortable with!

Do I Have to Say “No GST Charged” on the Invoice?

Yes, you really should. It makes it clear to your customers and keeps you on the right side of the law.

Can I Add My Logo?

Of course! Most templates let you add a logo. It’s a good way to make your invoice look even more pro.

How Do I Keep Track of These Invoices?

Always save a copy for yourself. You’ll need it for your records and if you ever get asked about it later.

Conclusion

Using a No-GST Invoice Template in Australia is a smart move. It helps you, helps your customers, and keeps you on the right side of the law. So, the next time you need to make an invoice without GST, grab one of these templates and fill it out. It’s that easy!