If you’re looking for a way to improve your finances, an invoice template in Excel is the perfect tool. This QuickBooks Invoice Template Excel will allow you to make professional-looking invoices fast and efficiently. This blog post will explain how to create it and discuss some benefits and tips for using this valuable tool. So whether you’re just starting with accounting or looking for a faster and easier way to do your invoicing, be sure to check out.

Why use a QuickBooks Invoice Template Excel?

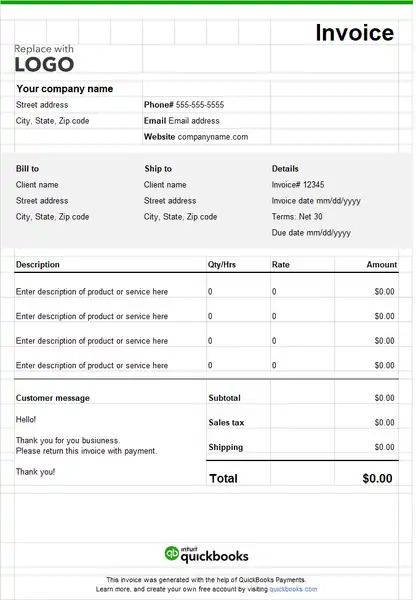

QuickBooks is a versatile and easy-to-use invoice template that can assist in keeping while. The template’s customizable fields make it perfect for quickly designing and sending invoices, while the automatic numbering makes it manageable to maintain the way of payments.

QuickBooks also recommends using an invoice template if you want your finances to improve. Following specific financial guidelines when creating or using an invoice can improve your records’ organization and clarity. Additionally, It is reliable and efficient. It will help reduce paperwork and optimize business processes.

How to customize it

Customizing is a great way to improve your finances, save time by customizing your invoice templates, and better manage your finances.

- Customize the Appearance of Your Invoice: If you like to make sure that the layout of your invoice looks experienced, there are several things you can do to help achieve this goal. First, select a theme that matches the style of your company’s website or business cards. Then use fonts and colors that reflect your organization’s tone and brand identity. In addition, adjust layout options such as font size, spacing between lines on an invoice form, margin widths around fields, etc.

- Save Time with Customized Invoice Templates: You can streamline many common financial tasks using customizable Quickbooks. For example, by creating pre-made invoices for specific customer types or products, you will not have to spend time entering data into each transaction. This will save considerable amounts of time in comparison to manually completing each Billable Item every month

- Keep Track Of Financial Data with Professional looking Invoice Forms: A well-designed invoice provides valuable information about how much money was spent on what, which helps managers track spending trends over time and makes budgeting easier overall

How to create an invoice template in excel

Creating an invoice in excel is a great way to organize your finances and track expenses. Using the right template ensures that all invoices are accurate, detailed, and easy to customize.

To start, open up Excel, navigate to the “File” menu item, and select “New” from the drop-down menu. On the new screen that pops up, enter “Invoicing Template” as the name for your project. Next, click on the “Sheet Options” tab at the top of your spreadsheet, and under “Name & Extension,” make sure that “File Type: .xltx” is selected (other file types may work, but xltx is recommended).

Now let’s take a look at what each column inside our invoice should contain:

Column 1: Vendor Name

Column 2: Description of Service or Product You Received

Column 3: Unit Price/Amount Paid

Column 4: Payment Method Used (If Different Than Check)

Finally, we need to add some data specific to our business, so fill out columns 5 through 12 with appropriate information! For example, if you are billing monthly by credit card, you would enter “Credit Card Number” into column 5, “Expiration Date” into column 6, etc.

The best time to send out your invoices

When it comes to sending out invoices, timing is everything. You want to send them when your customers are most active, and you have the most money in your account. Unfortunately, this can be challenging because expenses vary greatly depending on the month.

To make things easier for you and boost your profits, QuickBooks provides a built-in invoice template that calculates when you should send out each type of invoice based on current financial data. This makes it easy to stay organized and track which bills need payments sent immediately and which ones can wait until later.

The best time to send out an invoice depends on a couple of factors: how much money is in your account at any given moment and how active the customer is currently. The QuickBooks Invoice Template Excel will help calculate when an invoice should be sent based on these variables so that all finances are accounted for no matter what month it is in.

The best way to track payments and expenses

The importance of tracking payments and expenses is clear. However, the process can be tedious and time-consuming. That’s where Quickbooks Invoice Template Excel comes in handy. This excel template makes it easy to keep track of your finances by automating common tasks like payment recording and expense categorization.

In addition, Quickbooks Invoice Template Excel can help you prepare your taxes efficiently. By tracking income, expenses, and debts, you will better understand how much tax you may owe. Additionally, keeping accurate records can prevent future financial issues from arising in the first place.

Benefits of using QuickBooks Invoice Template Excel

QuickBooks Invoice Template Excel is a great tool for those who want to keep their finances in order. The following are six benefits of using this software:

- You can see how much money you spend on each expense. This will help you stay under budget and avoid costly mistakes.

- Creating invoices fast will save you time and hassle.

- You will be able to get accurate estimates of your work schedule based on past results, avoiding any last-minute surprises or problems with billing.

- Quicken Invoice Template Excel is compatible with most versions of QuickBooks, so it’s easy to use, no matter your computer or device.

- It has been designed specifically for invoice management, offering additional features not found elsewhere.

6 . Overall, Quicken Invoice Template Excel provides users with everything they need to manage their finances successfully

Tips for using QuickBooks Invoice Template Excel

There are many reasons to use QuickBooks Invoice Template Excel, but here are five of the most common:

- To save time and money by automating your invoicing process

- To improve the accuracy and clarity of your financial data

- To get organized quickly and easily with standardized templates

- To reduce stress while preparing your monthly income statements and tax returns

- To stay compliant with various statutory requirements such as Sarbanes-Oxley or GLBA

Conclusion

Thank you for reading this blog post. In this article, we discussed the benefits of using QuickBooks invoice template Excel and gave tips on how to use it most effectively. Following these steps, you can perfect your finances and succeed in your business endeavors.