In the world of business, invoicing and payment terms go hand in hand. As a business owner, it’s crucial to establish clear and concise payment terms to ensure the smooth flow of cash in your business operations. One of the most common invoice payment terms 14 days, and in this article, we’ll explore why it’s the optimal choice for many businesses.

Advantages of 14 Day Payment Terms

The Advantages of 14 Day Payment Terms are:

Maintains a Healthy Cash Flow

Setting a payment term of invoice payment terms 14 days allows businesses to receive payment promptly and maintain a healthy cash flow. This short payment window ensures that invoices are paid on time and reduces the risk of outstanding payments, which can negatively impact a business’s finances.

Encourages Prompt Payment

A 14-day payment term sets a clear expectation for clients to pay their invoices promptly. This can help reduce the number of overdue payments and improve a business’s financial stability.

Provides a Reasonable Payment Window

Invoice payment terms 14 days is a reasonable payment window that strikes a balance between being too lenient and strict. It provides enough time for clients to process and pay the invoice without being so long that it becomes easier for businesses to manage their cash flow.

Aligns with Industry Standards

Many businesses and industries have adopted a 14-day payment term as a standard, making it a widely accepted practice. This helps to simplify the invoicing process, as clients are familiar with this payment term and know what to expect.

Read Also: Invoice Tracking Software Free

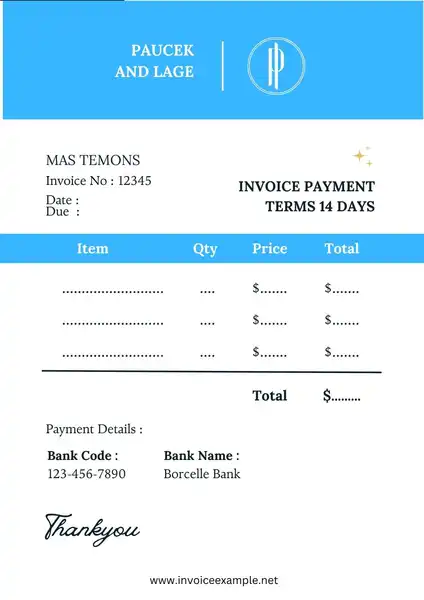

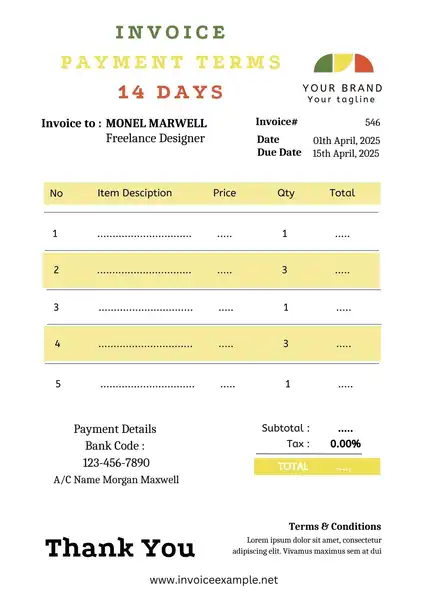

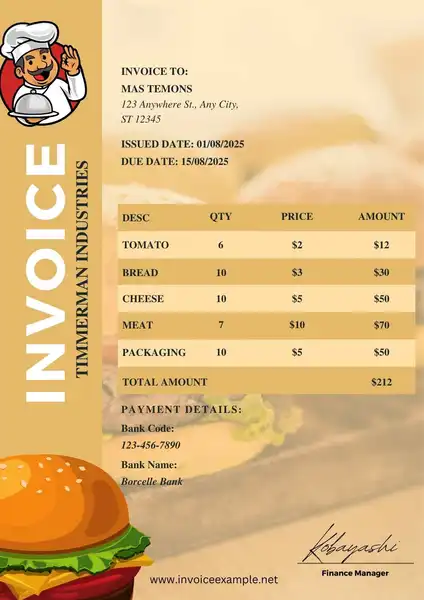

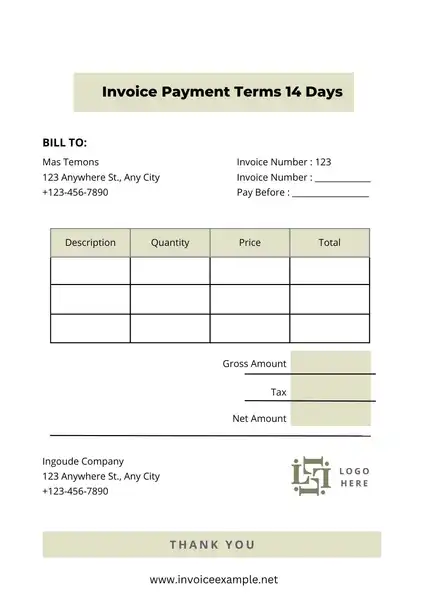

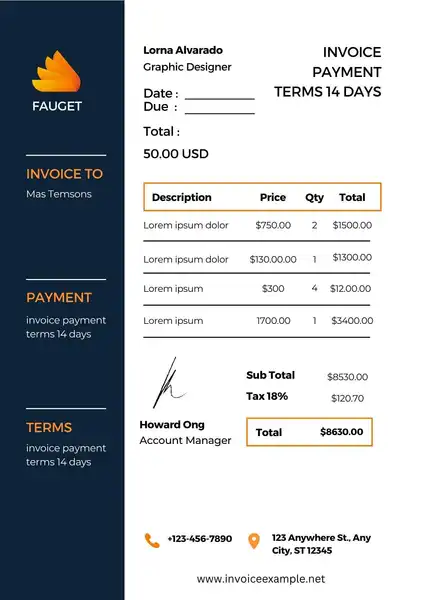

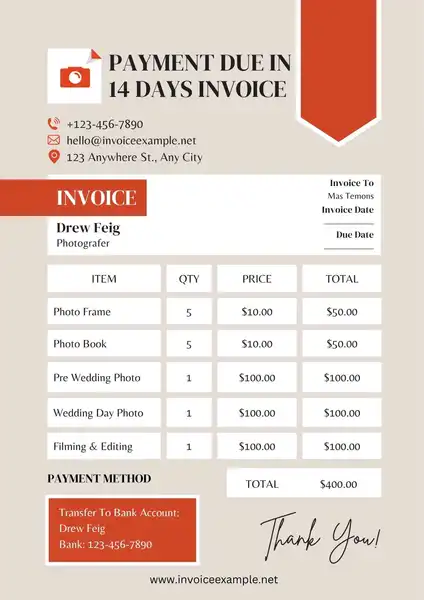

Invoice Payment Terms 14 Days Template

Below are Invoice Payment Terms 14 Days Template:

What are the biggest challenges when receiving payment within 14 days of invoicing?

For any business, receiving payment on time is crucial to maintaining a positive cash flow and avoiding financial difficulties. However, despite a company’s best efforts, numerous challenges can arise when receiving payment within 14 days of invoicing. From client disputes to administrative errors, these obstacles can cause significant payment delays and negatively impact a business’s financial stability.

Slow Payment from Clients:

One of the most common challenges businesses face when receiving payment within 14 days of invoicing is slow payment from clients. This can be due to various reasons, such as clients having cash flow problems or simply needing to prioritize payment to suppliers. Businesses can negotiate payment terms with their clients and set up automatic payment processes to ensure timely payment.

Administrative Errors:

Another challenge businesses face administrative errors that can lead to delays in payment. This can include incorrect invoicing, miscommunication between parties, and incorrect payment information. To avoid these errors, businesses can invest in invoicing software, establish clear communication channels, and regularly review payment processes to ensure they are accurate and efficient.

Disputes with Clients:

Disputes with clients can also lead to delays in payment. These disputes can arise from disagreements over the service quality or the amount charged on the invoice. To resolve these disputes quickly, businesses can establish clear communication channels, have a dispute resolution process in place, and work towards finding a mutually acceptable solution.

Late Fees and Interest:

Late fees and interest can also be challenging for businesses to receive a payment within 14 days of invoicing. These fees can accumulate quickly and significantly increase the amount owed by the client, making it more difficult for businesses to receive payment on time. To avoid these fees, businesses can negotiate payment terms with their clients, send reminders for upcoming due dates, and establish clear consequences for late payments.

Lack of Awareness of Payment Terms:

Finally, a lack of awareness of payment terms can also be a challenge for businesses trying to receive a payment within 14 days of invoicing. This can occur when clients need to be made aware of the payment due date or are unfamiliar with the agreed-upon payment terms. Businesses can include payment terms in contracts, provide clear invoices, and educate clients on payment.

Why 14 Days is the Optimal Choice

Provides Adequate Time for Invoice Processing

Invoice payment terms 14 days provide enough time for clients to receive, process, and pay invoices. It allows clients to review and check the invoices for accuracy and make necessary adjustments before payment.

Avoids Late Payment Penalties

A 14-day payment term helps to avoid late payment penalties, as it provides a reasonable timeframe for clients to pay their invoices. This can help improve business and client relations, as late payment penalties can cause friction and harm the relationship.

Supports Positive Cash Flow

By receiving payment promptly, businesses can maintain positive cash flow and ensure they have the funds available to meet their financial obligations. This helps maintain the business’s financial stability and supports future growth.

Invoice Payment Terms 14 Days Example

| Invoice | |

|---|---|

| Invoice Date: | [Insert Date] |

| Invoice Number: | [Insert Number] |

| To | |

| Customer Name: | [Insert Customer Name] |

| Address: | [Insert Customer Address] |

| City, State ZIP Code: | [Insert Customer City, State ZIP Code] |

| From | |

| Your Name/Business Name: | [Insert Your Name/Business Name] |

| Address: | [Insert Your Address] |

| City, State ZIP Code: | [Insert Your City, State ZIP Code] |

| Description | |

| [Insert a brief description of the goods or services provided] | |

| Amount Due | |

| [Insert Total Amount] | |

| Payment Terms | |

| Payment is due within 14 days of invoice date. Late payments may result in additional fees and interest charges. | |

| Accepted Payment Methods | |

| Bank Transfer: | [Insert Your Bank Details] |

| Credit Card: | [Insert Credit Card Details] |

Invoice Date: [Insert Date]

Invoice Number: [Insert Number]

To: [Insert Customer Name]

[Insert Customer Address]

[Insert Customer City, State ZIP Code]

From: [Insert Your Name/Business Name]

[Insert Your Address]

[Insert Your City, State ZIP Code]

Description:

[Insert a brief description of the goods or services provided along with any relevant details such as quantities, unit prices, and subtotals].

[Insert a detailed breakdown of the charges, including any taxes, shipping, or other fees that apply].

Amount Due: [Insert Total Amount]

Payment Terms:

We kindly ask that payment be made within 14 days of the invoice date to ensure timely processing. Late payments may result in additional fees and interest charges.

Accepted Payment Methods:

– Bank Transfer [Insert Your Bank Details]

– Credit Card [Insert Credit Card Details]

– PayPal [Insert PayPal Email Address]

If you have any questions or concerns regarding this invoice, please do not hesitate to reach out to us at [Insert Contact Information].

Thank you for your business. We appreciate your prompt payment and look forward to working with you again in the future.

[Insert Your Signature or Company Seal]

How to Implement 14-Day Payment Terms

They are reasons why 14 days is the optimal choice:

Step to Implement 14-Day Payment Terms

Steps to Implement 14-Day Payment Terms include: Evaluating your current payment terms and processes, Determining if a 14-day payment term is feasible for your business, Updating your invoices to reflect the new payment terms Ensuring your payment systems are set up to handle the new terms and Communicate the change to your clients

Communicating the Change to Clients

- Choose the right method of communication

- Be clear and concise in your explanation

- Highlight the benefits of the change

- Provide a clear timeline for the implementation

- Offer support and answer any questions clients may have

Making the Transition Smooth

- Be patient and understanding with clients

- Offer flexible payment options

- Continuously monitor the process and make adjustments if necessary

- Address any issues or concerns from clients promptly

- Foster a positive relationship with clients through open communication and understanding.

Conclusion

In conclusion, an invoice payment terms 14 days is an optimal choice for many businesses. It provides a reasonable payment window, aligns with industry standards, and helps to maintain a healthy cash flow. By establishing clear and concise payment terms, businesses can ensure smooth cash flow and support their financial stability.